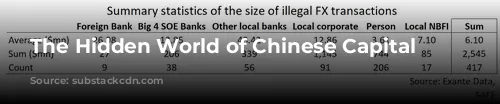

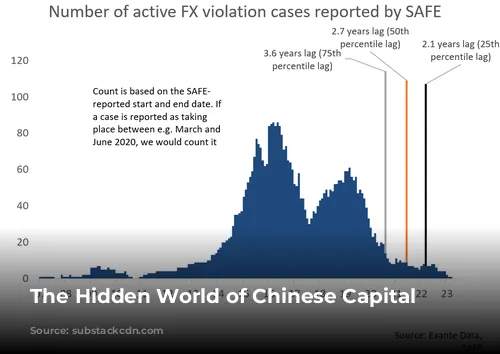

Everyone knows that money is leaving China, but how and who is doing it remains shrouded in mystery. While the Chinese government imposes strict capital controls, people and businesses are finding sneaky ways to move their money out of the country. This article delves into the shadowy world of capital flight by analyzing a unique dataset of 417 cases of illegal capital flight reported by China’s State Administration of Foreign Exchange (SAFE).

Who Are the Players?

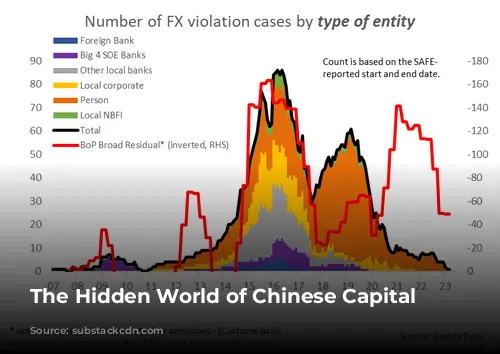

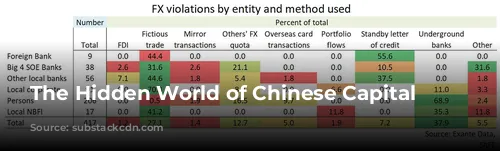

From 2015 to 2017, local banks and companies were the main culprits, using sophisticated tactics like fake trade deals and standby letters of credit to move money across borders. However, individuals have become the leading force since 2017, often using underground banks to bypass controls. This shift shows how the strategies used to move money out of China are constantly evolving.

The Methods of the Money Movers

Capital flight in China doesn’t just happen through one method. It’s a complex game with many tactics, and the preferred strategies have changed over time.

Fictitious trade, where companies over-invoice their exports to disguise the true nature of the transaction, was a common technique in the early years. The misuse of foreign exchange purchase quotas, allowing individuals to take advantage of loopholes in the system, also played a significant role.

However, underground banks have emerged as the dominant method for individuals since 2018. These secretive networks operate outside of traditional banking systems, facilitating illegal money transfers with ease.

The Data Tells a Story

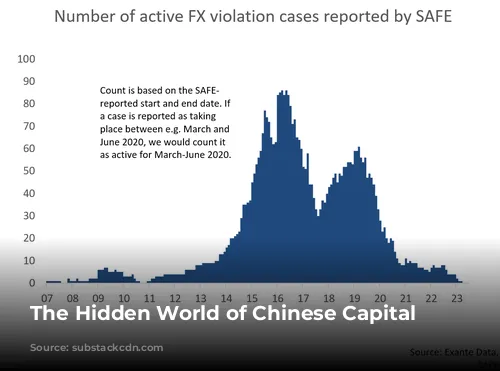

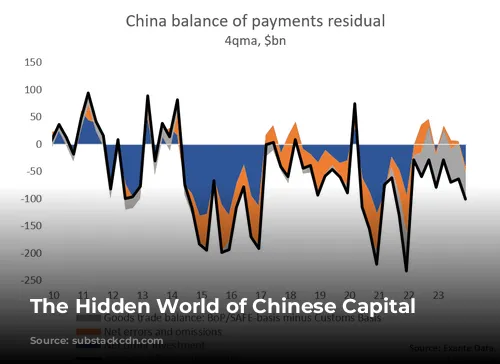

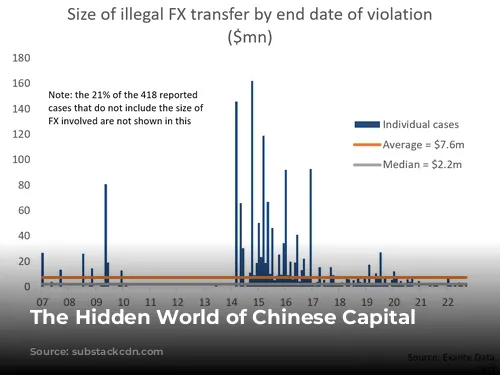

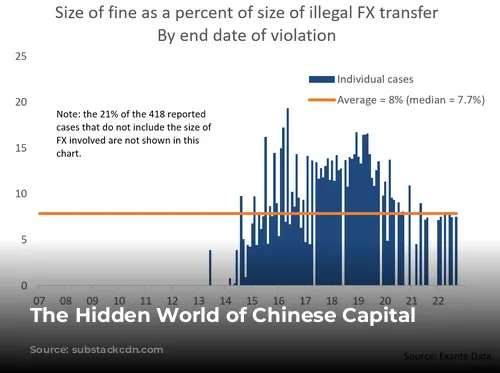

While the number of reported capital flight cases has fluctuated over the years, the sheer volume of money moved is staggering.

The average case involved a hefty $7.6 million, with a median of $2.2 million. The data also shows a significant decline in large-scale capital flight since 2017, a trend likely influenced by the changing methods used and the increased scrutiny from authorities.

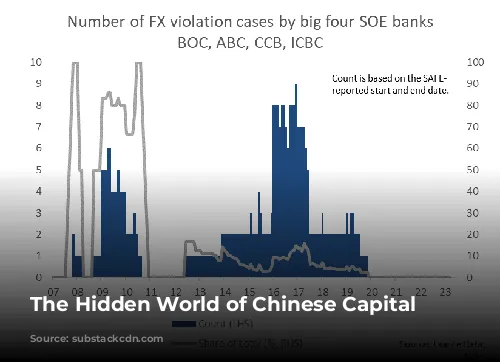

A Battle Between Wits

The Chinese government has cracked down on capital flight, employing sophisticated surveillance and tightened capital controls to curb the flow of money out of the country. But the game continues as individuals, businesses, and even local branches of state-owned banks find new ways to circumvent restrictions.

While the crackdown has been effective in reducing corporate capital flight, individuals have proven more resilient, often using underground banks to move their money. This suggests that the authorities face a formidable challenge in completely eradicating this illicit activity.

Looking Ahead: A Persistent Problem

China’s economic landscape contributes to the persistence of capital flight. Low interest rates, declining housing prices, and lackluster equity markets make investment opportunities within China less attractive. This encourages investors to seek better returns abroad, even if it means resorting to illegal means.

While the Chinese government is taking steps to address the issue, the battle against capital flight is likely to continue. The future of capital controls and the impact of technological advancements on enforcement remain to be seen. One thing is certain: the world of Chinese capital flight is a dynamic and fascinating one, full of twists and turns.